As we contemplate the prospects of a second term in the White House for Trump or Biden (330 million people and that's the best you can do?!), let’s recap on economic outcomes during their first terms in office.

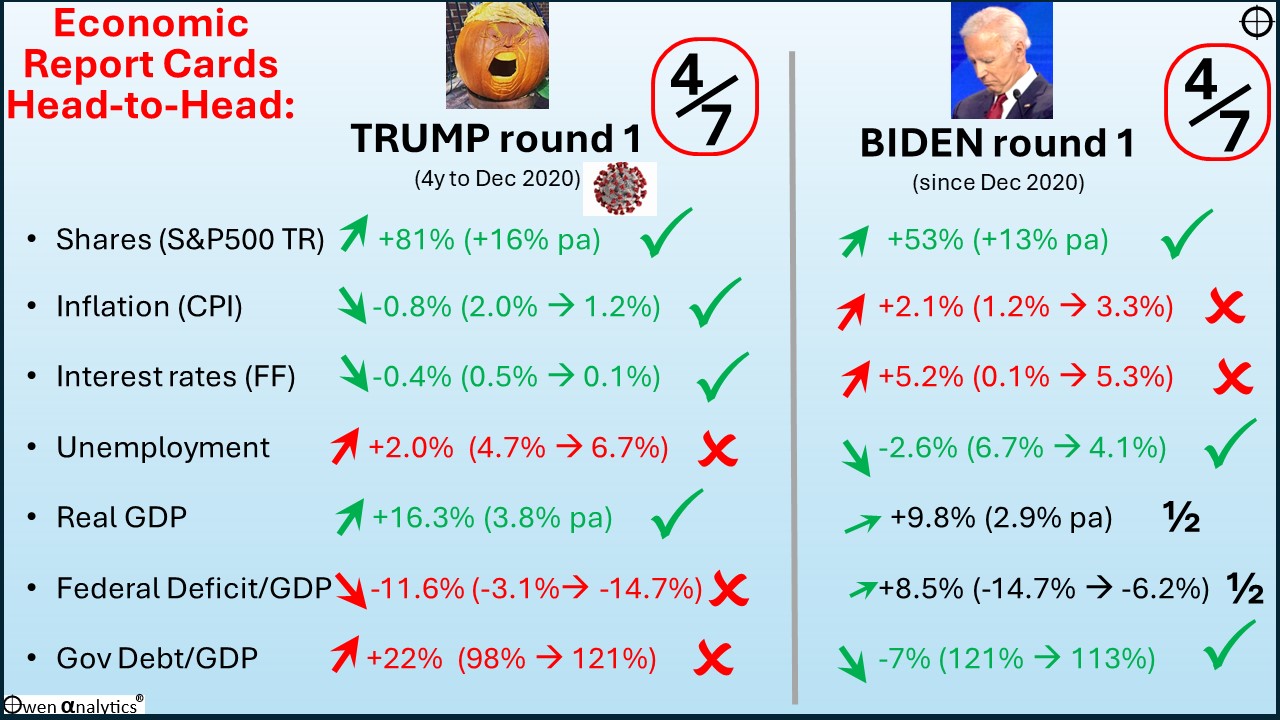

Here’s a quick report card based on seven key measures of economic outcomes. Of course we can debate which are the best measures to use. As an investor, the measures I selected here are the most important in driving investment markets and returns.

We can also debate causation – ie to what extent the Presidents’ decisions resulted in the outcomes.

There is also the issue of time lags between decisions and outcomes, but we are looking at four-year terms, which is long enough to smooth over most time lags, as investment markets mainly react to very short term news.

Covid

Of course, the elephant in the room that affects each of these economic outcomes was Covid (or rather it was government responses to Covid that caused the recessions, inflation, rate hikes, etc, not the disease itself).

Leaders are not always masters of their own destiny. Mostly, they just deal with whatever comes along while they are in office.

Covid just happened to arrive while Trump was in the White House, but he did start (or at least accelerate) the trade war with China. Biden’s first term included the fall-out from the Covid lockdowns and stimulus, plus Russia’s invasion of Ukraine, and escalating tensions in East Asia and the Middle East.

I am not attributing blame or causation here. I am merely measuring economic outcomes during the periods when each President was in the White House. This is not a full set of measures of course, but it’s not a bad start.

The report card:

Here are my scores on seven key measures over the two periods. For Trump, the period is the four calendar years 2017 to 2020 inclusive. For Biden, the period is from the start of 2021 to the most recent data.

I give them each a score of four out of seven!

Share markets

For share market returns, I give them both a tick, as the US share market soared and posted well above average returns during both periods. Under Trump, despite the savage Covid lockdown sell-off and deepest recession since the 1930s.

Under Biden, despite the once in a lifetime inflation spike, aggressive rate hikes, and wars breaking out in Europe and the Middle-East.

Inflation

A tick for the Trump years, when inflation collapsed with the Covid lockdowns. (Perversely, you could say there was causation here, as spending collapsed, and prices fell as people were locked in their homes and out of their businesses).

A cross for the Biden years as inflation soared due to the ultra-loose fiscal and monetary stimulus, plus supply chain disruptions from the lockdowns. (Again, I am not implying causation, just measuring outcomes.)

Interest rates

Same scores as for inflation. A tick for the Trump years, when interest rates were cut to stimulate activity in the lockdowns. A cross for the Biden years as rates were hiked to attack the resultant inflation.

Unemployment

A cross for the Trump years as unemployment soared in the lockdowns. A tick for the Biden years as unemployment fell rapidly in the stimulus-driven economic boom.

Real GDP

The Trump years get a tick for strong economic growth of 3.8% pa averaged over the period, despite the sharpest and deepest economic recession since the 1930s.

The Biden years get half a mark for mediocre economic growth averaging a below-average 2.9% pa, despite the once in a century fiscal stimulus.

Federal government balance / GDP

A cross for the Trump years as deficits soared to war-time levels due to the Covid lockdown disruptions.

The Biden years get half a mark for reducing the deficit from -14.7% of GDP back to ‘just’ -6% of GDP – an improvement but still very large and inflationary, especially since most of the spending is discretionary.

General government debt to GDP

A cross for the Trump years as debt soared from 98% to 121% of GDP with the Covid stimulus deficits. A tick for the Biden years as debt-to-GDP ratio has reduced. The actual level of spending has increased, but the economic pie has been growing by more, so the debt-to-GDP ratio is lower.

The bottom line?

You can argue all you like about causation, and whether you like the candidates’ personalities, politics, or policies, But you can’t argue with the facts.

The bottom line is that the first terms for Trump and Biden were both tremendous for share investors – in the US and around the world – despite the once in a lifetime pandemic, recessions, inflation spikes, aggressive rate hikes, trade wars, political fragmentation, and rising military tensions!

Whoever wins in November, the next President is sure to encounter a host of new challenges in the next four years.

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!