My last story was about the dozens of share markets hitting new highs this year. I wrote that story to dispel the widespread media myth that it is just the ‘Magnificent Seven' US tech giants lifting world share markets. see:

Dozens of world share markets are hitting new highs - the myth of the Magnificent-7

I was tired of answering questions from advisers and investors who were worrying that if they or their clients did not own shares in the ‘Mag-7’ they were ‘missing out’. In that story, I showed 33 country share markets – more than half of the markets I cover - were hitting new highs all over the world.

The rest

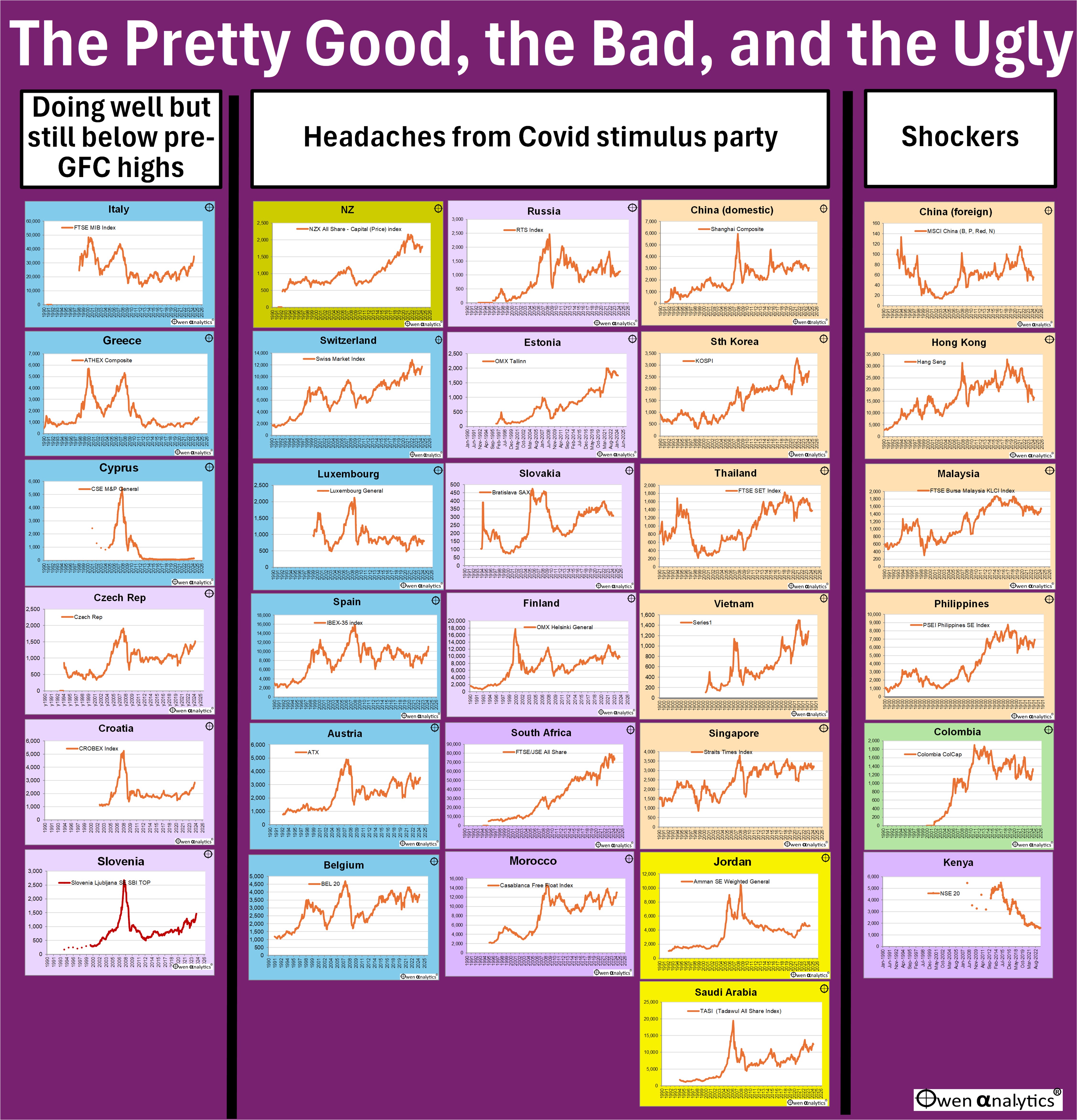

Here is a picture of the other 31 share markets I cover that are NOT hitting new highs this year - the ‘Pretty Good, the Bad and the Ugly’.

These countries fall into three groups:

1 - ‘Pretty good’ - doing well recently but still below pre-GFC highs

In the left column we have share markets that are doing well in recent years in the current global boom, but they are still below their pre-GFC highs.

The fact that they are still below their pre-GFC highs is mainly a function of the extent of their extraordinary pre-GFC booms and equally extraordinary GFC busts.

The bigger the boom, the bigger the inevitable bust.

The GFC was a long time ago now, but these charts are a good reminder that the traditional textbook ‘buy & hold’, ‘time-in-the-market’ theory only works if you are prepared to wait up to many decades to get back to square one, and even longer to make any actual returns.

Why do I highlight the booms and busts like this? Because hoards of first-time investors (and many professionals as well!) are lured into the booms at or near the top of the market, and they are still nursing big losses more than a decade later.

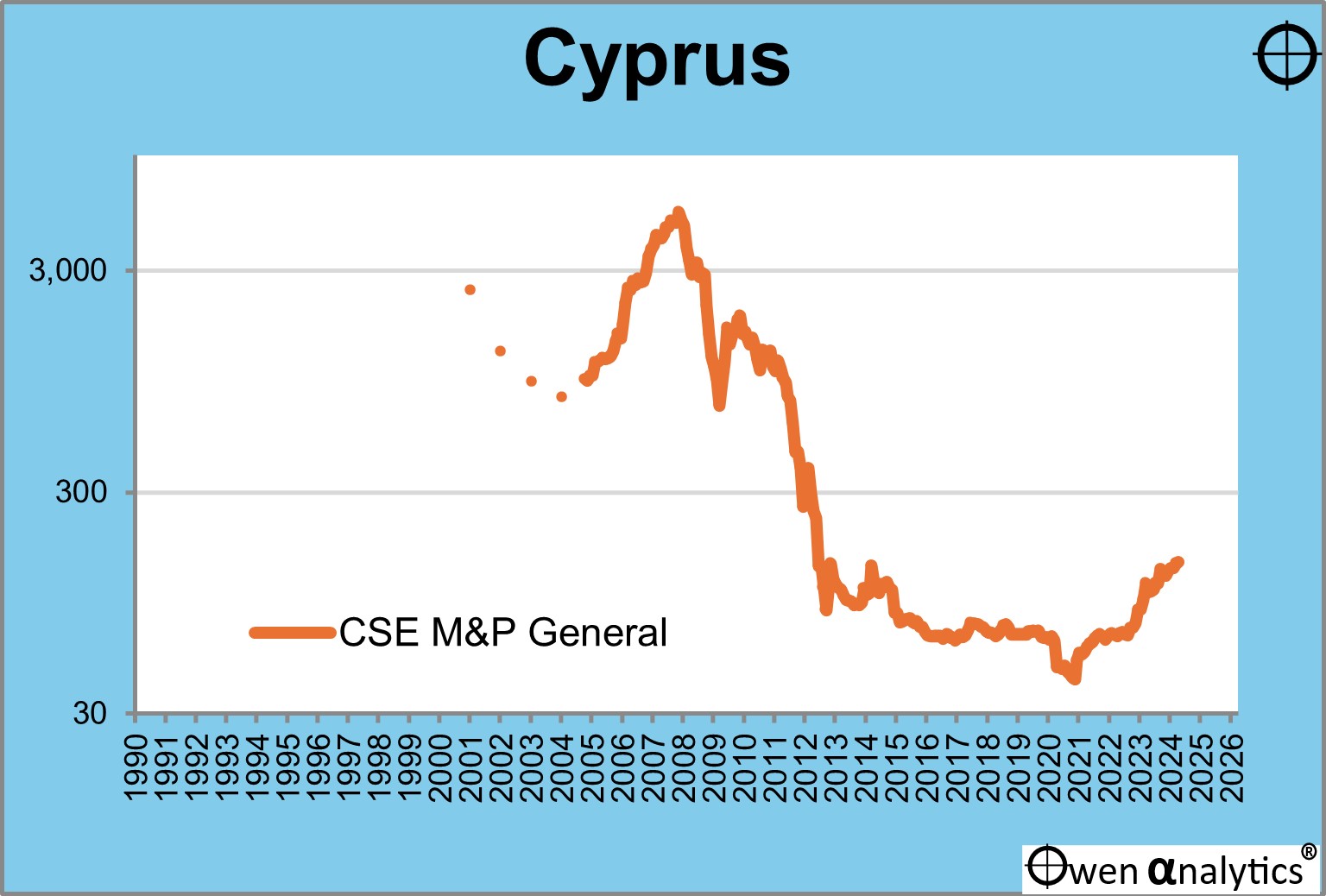

Cyprus

Cyprus deserves special mention here. Its stock market chart is half-way down the left column. The vertical axes in these charts are ‘nominal’ scales (like on a ruler). In the case of Cyprus, it looks like a complete collapse then flat-lining along the bottom since 2013.

In such extreme cases, it is handy to look at the picture using a ‘logarithmic’ or ‘ratio’ scale (like on a slide rule). Here is the vertical axis on a ‘log’ scale so we can see the movement more clearly:

(A note on chart scales - On the ‘nominal scale’ chart for Cyprus in the main picture at the top of this story, the numbers 0, 1,000, 2,000, 3,000, 4,000 are equally spaced along the vertical axis. If the price doubles from say 100 to 200, you can’t see it at all, but if it doubles from 2,000 to 4,000 it looks like a huge move. But on the ‘log’ scale chart here, it shows 0, 30, 300, 3,000 as equally spaced. This makes any doubling of prices – from 100 to 200, or from 2,000 to 4,000 – appear as the same size move – which is what it is for investors.)

On this log-scale chart we can see that the share market index has in fact risen quite nicely since 2020 (up by +240%), but it is still down some -97% from the pre-GFC peak.

What happened in Cyprus? Basically, Cyprus was a banking and holidaying tax haven for Russian billionaires. In the pre-GFC boom, Cyprus banks went mad lending to property developers catering for the Russian boom. The Cyprus banking sector grew on a scale similar to those in Iceland, Ireland, and Portugal.

Cyprus banks were also caught sitting on huge piles of almost worthless Greek government bonds. (In each of these countries, the sheer size of the bank collapses and bailouts caused their governments to default on their debts in the post-GFC ‘European sovereign debt crisis’).

I have an American friend who moved to Cyprus in 2012 to take up a new job in a global conference company based in Cyprus. She sold her house in Chicago and put the proceeds of the house sale into a Cyprus bank while she looked around for a new house in Cyprus for herself and her daughter.

Then the Cyprus banking crisis hit. Her bank was safe but another major Cyprus bank went bankrupt. The problem was that the Cyprus government confiscated her life savings in her ‘safe’ bank even though the crisis didn’t even affect her bank! Because a neighbouring bank went bankrupt, the innocent depositors the other major Cyprus banks lost a big chunk of their life savings to bail out depositors in the bad bank!

To give a local example – it was as if you had your money on deposit in ANZ and ANZ was safe, but another bank, say Westpac, went broke. The government basically took deposits from depositors in ALL banks, including the good banks, to pay for the losses in the bankrupt bank. Talk about socialising the losses!

That’s the chaos of European bank regulation for you. Anyway, the Cyprus general banking collapse killed the stock market, and it has never recovered since. My friend took what was left of her savings and moved to Singapore to start a new career.

2 - ‘The Bad’ - still nursing headaches from the Covid stimulus party

In the middle column are the country stock markets that had an almighty Covid stimulus boom in 2020-2, and they have not yet recovered those highs.

Each has its own story – in Switzerland it was mainly healthcare stocks in the Covid boom, but they are hurting now. In New Zealand it was healthcare and tech stocks. In Russia it was the exit of people and capital after Russia invaded Ukraine, and so on.

There is nothing inherently ‘bad’ per se about these national stock markets. In time they will probably get back to the Covid stimulus boom levels and beyond, but it may take more time.

If the US Fed does not cut US interest rates as quickly or by as much as many people are banking on, then the US boom will probably unravel, taking other world markets with it.

3 – ‘The Ugly’

On the right we have a bunch of national stock markets that appear to have been going south for a while, against the tide of the global boom.

The one of most interest to Aussie investors is China. Here I show two charts for China – one for Chinese domestic shares (‘A-shares’ for local Chinese citizens) and another for classes of shares investable by foreigners (B-shares, P-chips, Red-chips, and N-shares).

I have always warned investors that the further you stay away from Chinese shares the better. Sure, you might be able to make a quick buck if you get the stocks and timing right, but basically it’s a casino, heavily reliant on government favours and capricious government policy decisions.

China is interesting for Aussie investors mainly because China is our largest export buyer (mainly rocks, dirt, and gas), making it the largest single contributor to overall ASX profits and dividends, and also the largest contributor to our government tax revenues.

In this current cycle, the problem is the collapse in the property / construction / finance boom that drove China’s extraordinary growth (and Australia’s prosperity) over the past two decades. Who knows when or if that will be turned around.

I keep a close eye on China and its impacts on Australia – eg:

Chinese steel production – the ‘Sydney Harbour Bridge’ index

The Hong Kong market is also suffering, with its incorporation into mainland China, and the exit of confidence and capital. Each country has its own story.

The point I wish to make here is that it is a question of pure luck as to which country you happen to be born in and live in. Unfortunately, investing can often be about luck and timing. See:

Australia – lucky country for investors

Where is your country on the chart?

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!