Nothing scares investors more than news of a ‘recession!’ But why? Recessions have mostly been good for Australian shares!

That’s right. Contrary to the popular myth that recessions are bad for share markets, in the vast majority of economic ‘recessions’ in Australia over the past 150 years, the local share market has actually risen!

The deep 1990-1 inflation-busting, rate-hike ‘Recession We Had to Have’ was no exception. Here’s why…

Australia was a decade late in taming inflation

The 1970s era of high inflation was a global phenomenon. In the US and UK, inflation was killed off in deep, painful recessions at the start of the 1980s. Australia also had a long and deep recession in 1981-3 after the late 1970s property and mining booms here, but the Hawke/Keating government let inflation run at an average of 8.3% pa during the 1980s decade. Inflation in Australia was only finally tamed after cash rates were hiked up to 18% in late 1989, triggering the deep 1990-1 recession.

(Although the Hawke/Keating government let high inflation run on for a decade longer here than in the US and UK, they did tackle a raft of productivity-boosting economic reforms in the 1980s – including floating the dollar, removing capital controls, deregulating banks, allowing in foreign banks, curtailing union power, cutting tariffs, cutting individual and corporate tax rates, introducing capital gains tax, and dividend imputation, privatising government enterprises. The current Albanese government is now working to unwind many of those reforms – eg union power, workplace flexibility, subsidising/protecting local industries).

Shares surged in the recession

According to the popular definition of ‘recession’ as two consecutive quarters of negative growth in real GDP, the ‘recession we had to have’ occurred in the March and June quarters of 1991. What did share prices do? They surged!

In Australia, the US and several other countries that had recessions at the same time, the start of their ‘recessions’ marked the start of their share rebounds – almost to the day.

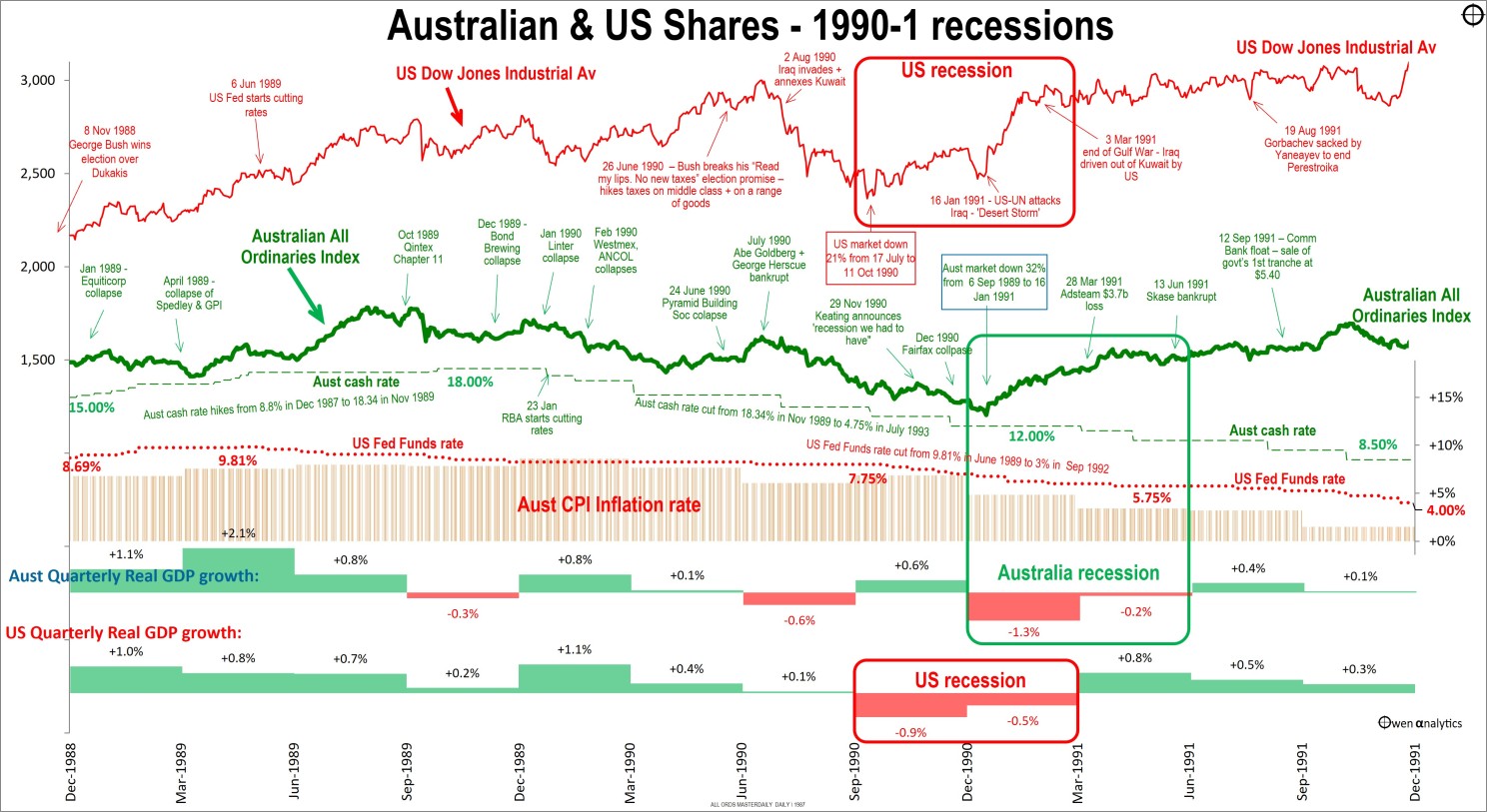

This chart outlines the main factors driving markets during the period. In the upper section of the chart, the red line is the Dow Jones Industrial index of US shares, and the green line is the Australian All Ordinaries Index. (We include US shares here to illustrate the fact that the Australian market almost always follows the US, regardless of local events and conditions).

The middle section shows cash rates - green dashes for Australia and red dots for the US. From a high of 18%, The RBA started cutting rates in January 1990 (while inflation was still running at 8.6%), six months after the US Fed had started cutting US cash rates in June 1989. In both countries, cash rates were being cut more than a year before their recessions hit.

Inflation tamed by rate hikes that killed companies and jobs

The lower section shows quarterly economic growth rates for both countries. The green and red boxes highlight the two consecutive quarters of negative real GDP growth – green for Australia and red for the US.

The orange bars show the annual CPI inflation rate in Australia, which finally came down to 1.5% pa by the end of 1991, when unemployment hit 10%. The ’Philips Curve’ worked - inflation was tamed by rate hikes that killed companies, jobs, and spending. In the current cycle – new RBA governor Michele Bullock says she is aiming for unemployment to increase to a rather benign 4.5%, to bring down inflation this time.

After the savage October 1987 crash, Australian shares had recovered part of their losses during 1988 and into 1989, but share prices started to fall again from September 1989 as the rate hikes took their toll. The 32% sell-off lasted 18 months and was peppered with almost daily announcements of bankruptcies and collapses of a host of over-geared ‘entrepreneurs’ like Skase/Qintex, Bond, Linter/Goldberg, Hooker/Herscue, Westmex/Goward, Fairfax, etc, as well as the finance houses that fueled the boom with loose lending - Rothwells/Connell, Spedley/Yuill, etc - and also some of the aggressive property lenders like Pyramid, Countrywide and Estate Mortgage.

“This is the recession we had to have!”

On 29 November 1990, when the negative GDP growth number for the September quarter 1990 was released in the midst of the bankruptcies and red ink, Treasurer Paul Keating uttered those famous words: “This is the recession we had to have!” He could hardly contain his delight at seeing the downfall of thousands of over-geared, greedy tycoons and their profligate lenders.

In the midst of the recession and bankruptcy crisis, with unemployment above 10%, Keating was able to oust his boss and reform partner Bob Hawke as PM, and then go on to win the 1993 federal election in his own right.

(The September quarter 1990 turned out to be a single one-off negative quarter for GDP. An isolated single negative quarter is not a rare event and does not qualify as a ‘recession’ under to the popular definition of two consecutive negative quarters).

Shares surge out of the depths of recessions

What impact did the ‘recession’ have on shares? Share prices rebounded almost immediately!

The 32% share market fall that had begun in September 1989, started to rebound quickly after the official recession began. During the March and June quarters of negative real GDP growth, the broad Australian share market jumped +17.7%, starting just 12 trading days after the recession began. US shares also rose +10.6% during the same period - not as much as Australian shares, but the US recession surge had started one quarter before ours.

The US economy also had a two quarter recession – indicated by the red boxes – starting and ending one quarter before Australia. US shares had also been falling before the recession – mainly after Iraq invaded and annexed Kuwait on 2nd August, but the US market also surged during the US recession. The Dow Jones index jumped +18.8% during the US recession, starting just 11 trading days after the recession began.

Share surges faded when economies resumed growth

What happened after the recessions ended? In both the US and Australia, the recession surges in share prices lost momentum when the recessions ended and economies started to grow again. Share markets in both countries kept drifting up further, but the recession surges had done their job in ending the share sell-offs.

Once again, economic ‘recessions’ were good for share markets!

This time is different – or is it?

Every cycle is different of course, but, given the long history of the Australian share market almost always rising during recessions, if the current phase of rate hikes does trigger another inflation-busting recession, there is a good chance it will be good for the share market once again!

What is different this time:

- Inflation is lower now – at ‘just’ 6% and declining, compared to 8.6% at the end of 1989.

- More importantly, inflation expectations are also much lower this time around.

- Cash rates are lower – they may reach say 6% in this cycle, much lower than 18% in 1989-1990.

- Unemployment is much lower now – at 3.6%, compared to 7.7% at the start of the 1990-1 recession.

- Pricing of shares is lower now – with far less aggressive/fraudulent accounting artificially boosting ‘profits’. Also, speculative property development activity is also less extensive, and less over-geared in the current cycle.

- Lending has been less frenzied/stupid this time, and banks also are much better capitalised to absorb bad debts. Lower likelihood of major bank near-insolvency (unlike Westpac and ANZ in the early 1990s bad debt crisis).

- Governments are much more willing now to throw free money at anyone who puts their hand out. The Commonwealth treasury is literally rolling in cash from windfall gains from mining taxes, and they will probably not hesitate to spray it around again to anybody and everybody in the next crisis.

The lesson for investors is – ignore the scare-mongering media headlines and focus on what really drives markets.