This week Dr Don Stammer gave the opening address at Financial Standard’s annual Chief Economists Forum in Sydney and Melbourne, to cap off his 60 years in investment markets.

Dr Stammer has been Australia’s best known economic writer, speaker, and commentator for the past 40 years. I am also very happy to say that he has been a close friend, collaborator, and supporter of mine over the past 20 of those years.

In his speech summarising his lessons from the past 60 years in investment markets, he used only 2 charts, and I am happy to say that they were both mine!

Don’s four key themes

In his address he outlined four key themes for investors:

1 . The power of compounding.

It is important to start investing early. By the time most people discover the power of compounding, it is often too late to benefit from it.

2 - Always allow for cycles.

The main causes are the ‘madness of crowds’ and over-reaction by and from macro policies. The vast majority of economists are wrong in forecasting cycles, eg recessions, and recoveries.

3 - ‘Timing’ and ‘Time-in’ the market are equally important for investors.

‘Time-in’ the market is important to get the benefits of compounding, but ‘Timing’ is just as important – to pick up bargains when they are cheap in market sell-offs.

4 - Be optimistic.

Ignore the constant negativity of economics, media commentators and other investors, who tend to focus on bad news and ‘risks’.

Cycles – inflation

To illustrate his second theme – Cycles, he focused on the hot topic in the current environment – Inflation.

Most of today’s investors and commentators have never experienced inflation before in their working lives. They think it is a whole new factor that has appeared out of nowhere in the past couple of years.

The assumption driving current market pricing (shares, bonds, property) is that the recent bout of inflation is an anomaly, and it will soon return neatly and quickly to target levels, which will allow interest rates to be cut significantly over the next year.

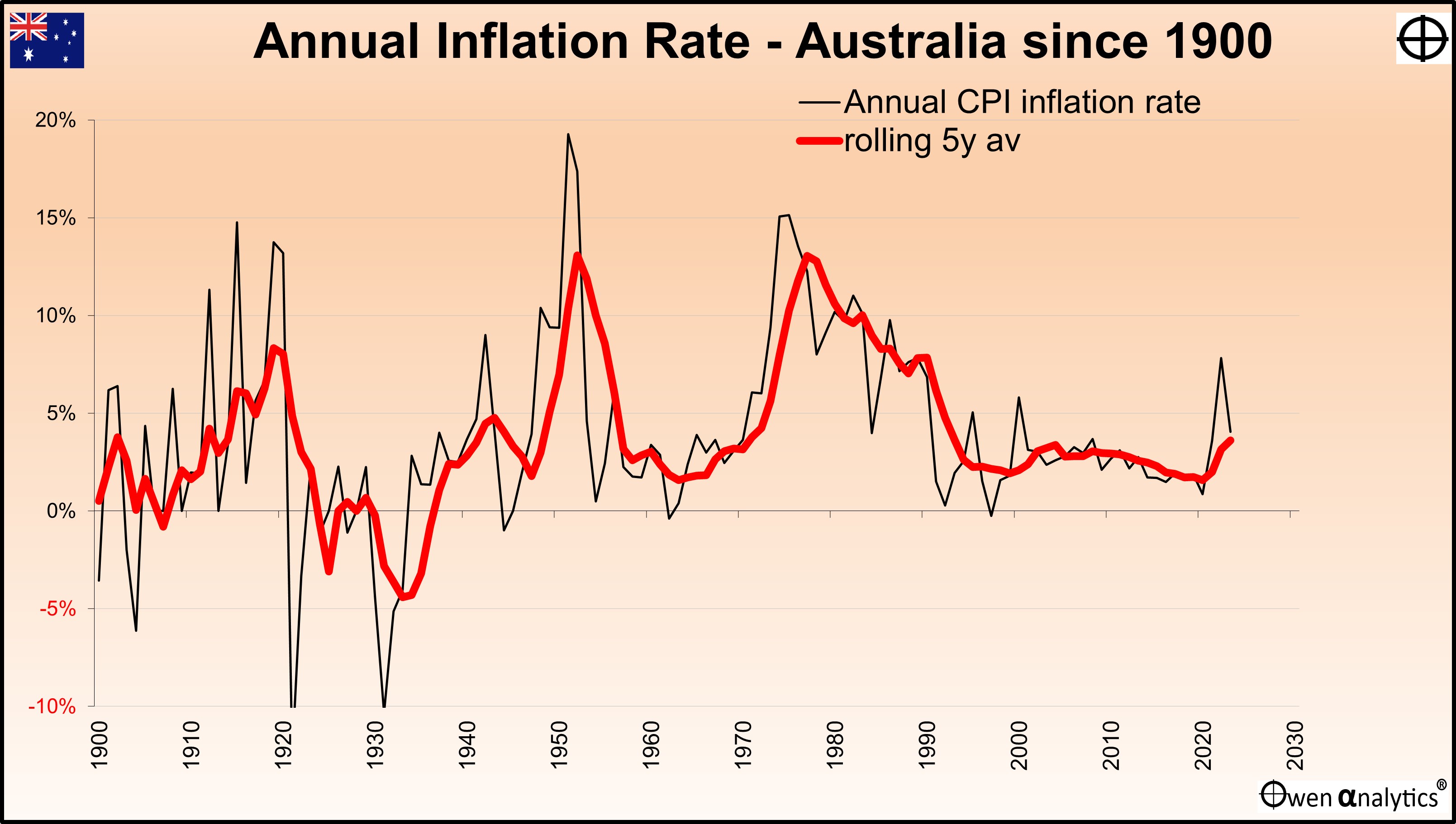

Don used one of my inflation charts to illustrate how wrong that set of assumptions is –

The chart shows inflation cycles in Australia (which more or less mirrors the US) since 1900.

In reality, inflation is not a sudden, new phenomenon that will quickly disappear. It just going through one of its cycles. In fact, the recent bout of inflation has been rather mild compared to past cycles.

2008-2020 period of low inflation and interest rates was the anomaly

Don’s view is that inflation and interest rates are not going to return quickly or neatly back to the ultra-low levels of the post-GFC era.

The post-GFC era of ‘ZIRP’ (zero interest rate policies) and ‘QE’ (‘quantitative easing’ ie central bank money-printing) was an anomaly and will not be repeated. All they did was produce inflation, huge debt burdens, and asset price bubbles.

Don said that the current inflation cycle is only 'half-way' through. Inflation and interest rates will not suddenly return to recent lows, as is assumed by current pricing and sentiment. They will remain elevated for some time.

Be optimistic

To illustrate Don’s fourth theme – Be Optimistic, he used another of my charts, one that I have been updating for many years.

It started out as ‘101 Reasons NOT to Invest’, but now, in 2024, it is now up to ‘124 Reasons NOT to Invest!’.

I published it here at the start of this year.

The point is that every year there are always good reasons NOT to invest. At any given time there is always a war, revolution, political crisis, natural disaster, corporate collapse, assassination, military invasion, inflation spike, recession, market crash, etc, going on somewhere in the world. Often on our doorstep, and often in our own country.

Despite this constant barrage of new risks every year to spook investors, the chart shows that the Australian and American share markets have powered through them all in the 124 years since 1900.

For every year I list a bunch of risks that would have scared off investors at the time, but the share market powered through them anyway – even the ‘World Wars’ and ‘once-in-a-life-time’ crashes!

Congratulations Don on a wonderful career! I am very grateful to be a (very small) part of it.

See also: