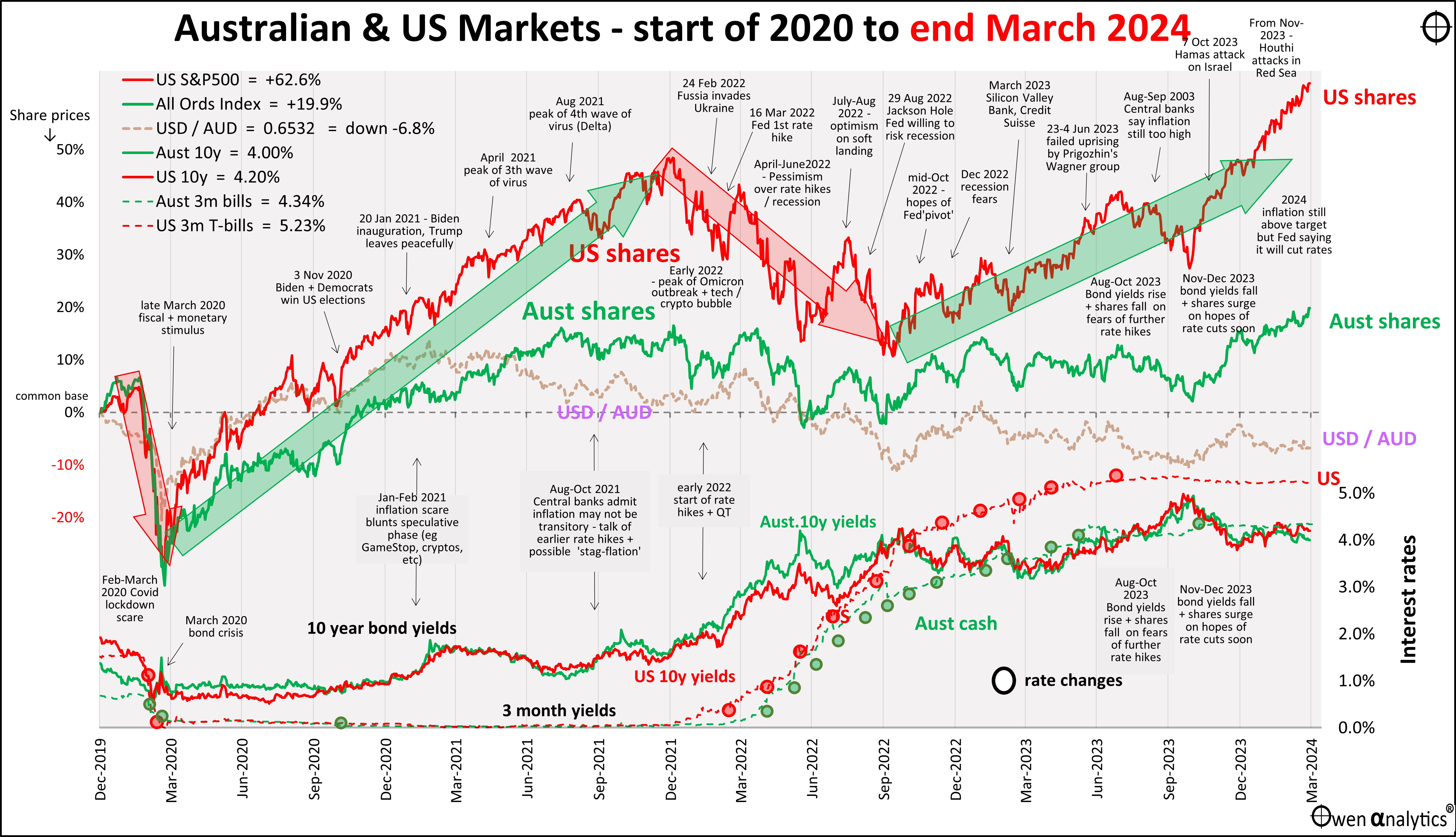

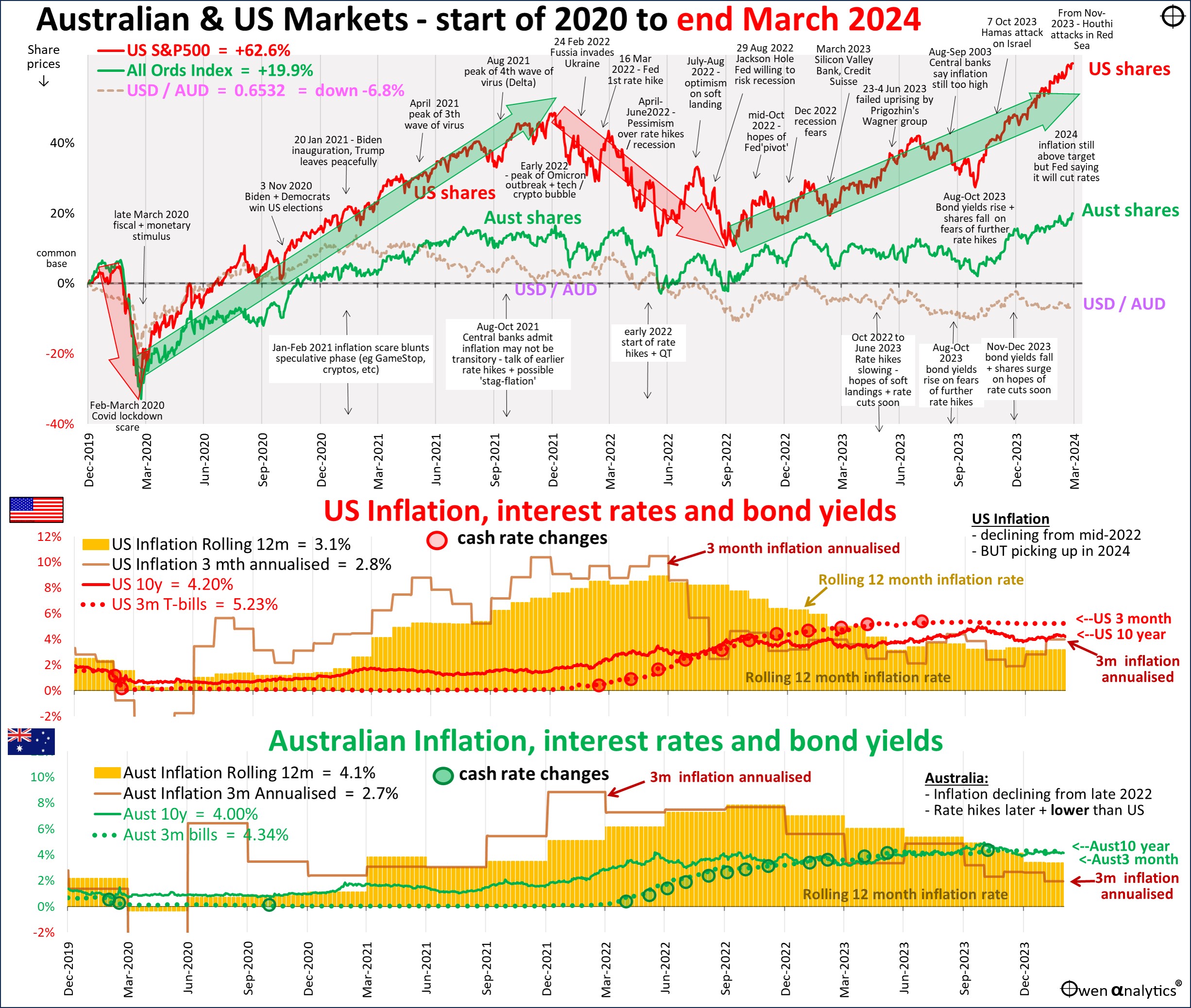

Here is my essential 1-page snapshot for Aussie investors – covering Australian and US share markets, short- and long-term interest rates, inflation, and Aussie dollar.

There are two versions – first is the traditional version on a single chart:

Also the alternate version requested by several advisers - showing inflation (rolling 12 month annual rate, and annualised rolling 3-months) in Australia and US -

The stand-out feature is that shares have kept surging, at an accelerated pace, despite warnings from the Fed that inflation remains higher than expected, while economic growth and jobs markets remain rather strong.

Inflation

The most important factor driving all global investment markets is still US inflation.

In the middle of March, US inflation for February came in at +0.4% for the month, bringing the annualised three-month running rate to 4.0%, and 3.2% pa year-on-year.

We can see from the US chart that the annualised three-month running rate had fallen back to just 1.9% in December 2023 but is now on the rise again in January and February.

Although most categories of goods inflation are falling, fuel prices are now rising again. Oil prices rose by +6% in January, +3% in February, and another +6% in March, so this will be reflected in March inflation numbers when they come out in April.

Surprisingly, the Fed is still having a bet each way – remaining concerned about inflation remaining above target due to wage inflation and strong economic growth (and now oil prices), but still talking about cutting rates this year. Go figure!

Australian inflation is doing a little better. February inflation was just 0.15%, the annualised three-month running rate was down to 2% in February, and 3.4% year-on-year.

The RBA has also repeated its concerns about inflation remaining sticky and has warned of the possible need for further hikes. The unemployment rate in Australia fell back below 3% again on strong jobs growth.

The good news highlighted in the in the second chart above is that to the right of the orange inflation bars for both the US and Australia, cash rates are now above inflation. The Fed and RBA can sit on this for a few more months and hope that this is enough to keep inflation heading lower toward target.

It is certainly still very premature to be pricing in significant rate cuts in the months ahead.

Japan finally off the juice!

The other major central banking news of the month was that the Bank of Japan finally ended its long regime of negative interest rates and QE (quantitative easing, or money printing) on 19th March, lifting its target cash rate back to a zero to 0.1% range.

The Bank of Japan has been running zero or negative interest rates for almost all of the time since February 1999, and ‘QE’ money printing since March 2001.

The ‘good news’ (if you love inflation, that is) is that Japanese inflation has been above 2% for the past two years, the yen has been thoroughly trashed (down -50% against the US dollar since the start of ‘Abenomics’), but the Nikkei has soared +290%.

Job done!

Let’s not worry about government debt at 260% of GDP just now – it’s time for another political corruption scandal!

Shares up everywhere

The combination of strong US economic growth the plus hopes of imminent rate cuts from the Fed (try to figure out how those two are consistent!) continues to boost share markets everywhere. March was the fifth strong month in a row since the mini-sell-off (hard landing scare) in July-October 2023.

All global sectors were up in March (even REITs) for the first time this year.

The star again was Nvidia – up another 14% in March on strong results plus the announcement of a new, even more powerful chip (‘Blackwell’, with 208 billion transistors somehow crammed onto each chip that is the size of the palm of your hand) to power the global A.I. revolution. Nvidia is now up 82% for 2024 to date (and was up 239% in 2023).

On the other side, Tesla was down another -13% in March, and -29% for 2024 to date (taking back part of its 100% rise in 2023). Apple was also lower with further problems in China and anti-trust actions.

All other global share market sectors were also up in March. Among the strongest were fossil fuel stocks, with rising oil prices, and banks, with strong economic growth putting to bed earlier fears of imminent recessions. Industrials were also mostly stronger, except Boeing, where the wheels (and engines) continue to fall off.

Reddit IPO – another omen?

Probably the highlight of the month was the US float of Reddit, which after a few failed attempts to get up as a social media stock in the 2020-1 Covid stimulus tech boom, was somehow dressed up as an A.I. stock (!) and it took off like a rocket!

This may turn out to be the ‘Coinbase’ moment that marks the top of the current speculative tech boom. (The Coinbase IPO in April 2021 marked the top of the Covid stimulus tech boom that unwound in the savage sell-off in 2022).

Donald Trump also jumped on the A.I. bandwagon and floated his ‘Truth Social’ platform (Trump Media) at the end of March. This will give him access to a few billion dollars to pay fines and election costs once his vendor shares come out of escrow later this year.

For a deeper dive into the US share market and whether it is over-priced,

see: US shares: double-whammy of over-pricing, but how serious is it?

Not just US shares

The share market party was not just in the US. All major countries share markets are up in March (even China). Share markets were hitting new highs everywhere. The All Ordinaries Index here hit 8,000 for the first time ever, and Japan’s Nikei225 hit 40,000, finally regaining the previous high at the end of 1989. Thirty-four years is a long time to wait for a recovery!

I will cover Japan in a separate story shortly.

Australian shares

Australian shares ended up +2% in March, bringing it to a respectable +4% for the quarter. The banks were stronger, on fading fears of a local recession, except Westpac was flat in March (but head of the pack for the quarter). The big miners were more or less flat (see commodities prices below), but the big gains were in gold stocks, with the strong gold price rise in March.

Listed property trusts (REITs) had another good month of recovery from over-sold levels relative to unlisted trusts which are mostly yet to come clean with valuation write-downs. There is probably some upside left in local REITs, unlike US REITs where there are deeper problems brewing in several major office markets.

The lifting of Chinese tariffs on Aussie wine was a welcome change at the end of the month, but it was already priced into the main producer/exporter Treasury wines.

Commodities markets

The iron ore price is the single largest driver of the overall ASX market, and iron ore was down another 11% in March. It is now down 27% this year, and almost back to $100/tonne. (NB. Miners’ lock in set prices in long term contracts that are unaffected by the ‘spot’ prices that jump around daily. However, changes in spot prices are what drive investor sentiment and knee-jerk buy/sell activity which drives share prices).

For more on the Chinese steel market -

see: Chinese steel production – the ‘Sydney Harbour Bridge index’

The bubble in battery metals prices continued to deflate in March – nickel was down a little, copper was up a little, and lithium is also up in a small mini-bounce, but is still down some 80% its late 2022 peak.

The big mover in March was gold - up 8% and hitting new highs, as inflation rates subside.

(The gold price soared when inflation was negative in the mid-2020 Covid lockdown crisis, and then gold fell sharply when inflation soared everywhere in 2022, so it has hardly been an inflation hedge).

For a deeper look at gold and its effectiveness as an inflation hedge over short, medium and long holding periods -

see: Gold: Curious case of the 31-year itch?

Bonds

Government bond yields fell back a little in most markets (except Japan, which is just coming off QE) in March, producing small positive returns for the month. However, yields have still risen so far in 2024 (producing negative returns) in all markets except Italy and Switzerland.

Even if inflation miraculously returns to target ranges and stays there nicely, bond yields are still too low to contain inflation.

Yields on 10-year bonds should be at least 1% above cash rates (a ‘maturity premium’ as a reward for your money being locked for 10 years)

Non-inflationary cash rates need to be at least around 1% to 2% above long term-expected inflation (more in Australia, NZ, Canada and US, but less in slow growth Europe and Japan).

So, even if inflation does settle back at say 2% and stay there, then a non-inflationary cash rate would be around 3% or 4%, and 10-year yields would need to be around 4% to 5%. They are at the lower end of the range, or lower, in all markets.

Credit

In credit markets, credit spreads are already narrow across the board, but they narrowed even further in March, especially in US high yield, and emerging markets.

Thus, bond markets are priced on the assumption that economic growth remains strong and recession-free (narrow credit spreads), but inflation and cash rates are both going to fall back. Both cannot be true at the same time.

The only scenario that would bring inflation and cash rates down significantly this year would be an economic slowdown or recession that resulted in a sharp rise in corporate failures necessitating rate cuts to stimulate employment. That scenario would be great for government bonds (for a few months anyway) but would cause a sell-off in corporate bonds.

There would appear to be insufficient margin of safety in either corporate or government bonds at current levels.

Stay tuned for upcoming reports that investigate these issues and more!

‘Till next time – happy investing!

Thank you for your time – please send me feedback and/or ideas for future editions!