All investing involves political risk to some degree, especially in the mining game. Of all risks, political risk can be the most volatile, and least quantifiable, resulting in spectacular profits and/or devastating losses.

Here is a political pure-play punt for brave souls who might like to speculate on politics, as well as metals prices.

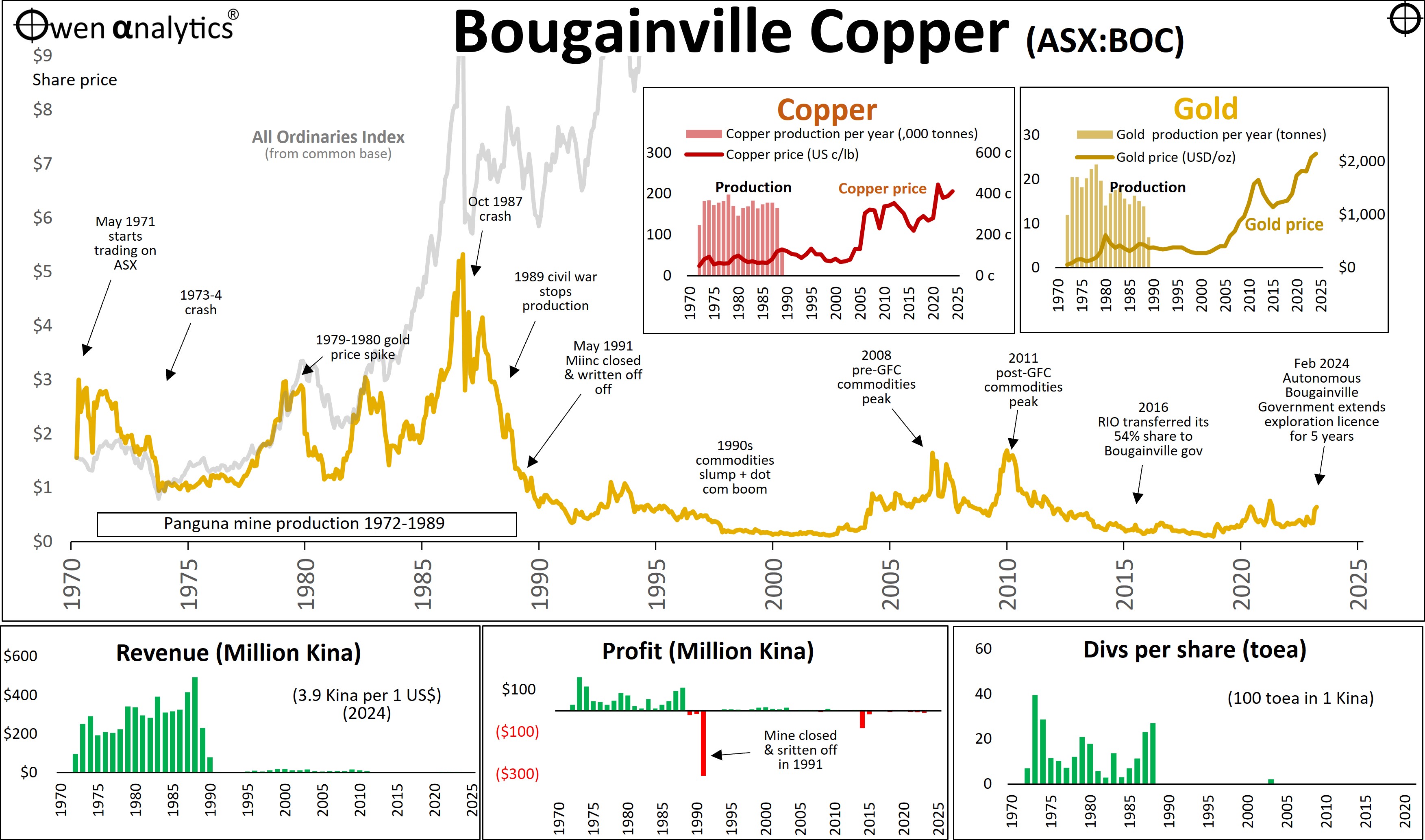

Bougainville Copper (ASX:BOC) is sitting on a gold mine – literally one of the richest and most profitable copper-gold mines in the world – but it’s been locked up for 35 years.

It was once a highly profitable ‘blue chip’ on the ASX, but revenues, profits and dividends disappeared suddenly due to political factors, making the shares almost worthless for the next 35 years of civil war and political disputes.

Immensely rich and profitable from day one

The ‘Panguna’ mine on Bougainville Island is one of the richest copper-gold mines in the world. It was the world’s largest open cut mine when it opened, and it was immensely profitable from the outset.

Since production began in 1972, it produced 3.1 million tonnes of copper, 306 tonnes of gold (9.9 million ounces), 783 tonnes of silver, and there is at least as much copper, gold and silver still in the ground, close to the surface.

The company has no debt, and it has A$100m in liquid investments and cash. It is still listed today, and you can buy it for one tenth of its 1987 peak share price.

What happened? At what price is it worth a political punt?

Best and worst of mining

This story illustrates the some of the best and worst aspects of large-scale mining. The positives are the tremendous flow of profits, dividends, and share price gains while the mine was open.

The other side of the coin was the dark side of mining – poisoned rivers, extinction of flora and fauna species, birth defects in indigenous populations, destruction of indigenous cultures, government bribery and corruption, ethnically-charged disputes over rights to work and royalties that escalated into a bloody, decade-long civil war that killed more than 15,000 people.

Unfortunately, these types of things go with the territory in the world of big mining. If investors want a piece of the action, they have to learn to just close their eyes and bank the dividends.

(Mining company reports are full of glowing pictures of smiling workers and happy local communities. Unfortunately, we know deep down that the further away they are from our cozy living rooms, the further the reports are likely to be from what actually goes on over there.)

Background

The island of Bougainville lies off the eastern tip of what is now known as Papua New Guinea. Geographically, ethnically, and culturally, it is more akin to the Solomon Islands than it is to PNG, and that is at the core of some of the problems involving the mine and deadly disputes over how the spoils should be shared.

In 1886, in the middle of the late nineteenth century scramble by European colonial powers to conquer the world and share the spoils between them, colonial rivals Britain and Germany chopped up the region in a deal that made Bougainville part of Germany’s ‘Bismarck Archipelago’, while the rest of the Solomons Islands were put under British rule. The locals had no say in this, of course.

In the First World War, Germany was defeated, so Bougainville was taken off Germany and handed over to Australia to administer.

In the Second World War, the Japanese invaded and took possession of the island, but when Japan lost the War, Japan had to hand back the island to Australia, as part of the Australia’s Territory of New Guinea.

Gold

Meanwhile, between the Wars, and while under Australian control, gold was discovered on the island in 1930, and copper in the 1960s. British/Australian mining company CRA (now RIO Tinto) owned the mining rights, and floated Bougainville Copper Limited on the ASX in 1971 to raise money to develop the mine.

CRA retained 54% control of the company, the PNG government owned 20%, and the remaining 26% went to the investing public at an initial issue price of $1.55 per share.

The locals received no shares, and no rights to any share of the revenues or profits!

ASX ‘blue chip’ stock

There was a mad rush for the shares when they listed in Australia in May 1971, which was at the tail end of the late 1960s mining boom. The share price closed at $3.10 on the first day, instantly making Bougainville worth more than the long-established Western Mining Corp (bought by BHP in 2005).

Bougainville developed the mine quickly and production started in 1972. At its peak prior to the 1987 crash, Bougainville Copper was the 25th largest stock on the ASX, worth $2.2b, earning $60m in profits and paying $60m in dividends per year. Royalties from the mine contributed nearly half of PNG government’s entire revenue base.

Problems brewing

The sharing of royalties between the PNG government and the local islanders on Bougainville was not the only issue of dispute. Another problem was that the indigenous Nasioi people of Bougainville are ethnically different from mainland Papuans and New Guineans.

Most of the mine workers were ‘red-skins’ brought in from PNG, and they were culturally and ethnically different from the ‘black-skins’ of Bougainville. The native Nasioi of Bougainville sought independence in their own right and in 1975 they declared their own independent Republic of the North Solomons.

However, in 1975 the Territories of New Guinea and Papua joined to became one nation as Papua New Guinea, which included Bougainville. The Bougainville Revolutionary Army fought a war of independence from PNG for ten years from 1988, costing more than 15,000 lives.

Australia followed the money and backed PNG in the civil war

In the civil war, Australia sided with PNG and backed the PNG military with financial and military support, to secure not only Australia’s commercial interests in the mine, but also as part of a broader fight against insurgents and uprisings across South-East Asia. The region was plagued with often bloody post-WW2 independence wars as locals fought to rid themselves of their colonial masters.

The outbreak of civil war on the island forced the closure of the mine in May 1989. It has laid dormant ever since, but the company is still listed on the ASX and it still owns the mine.

The value of the mine was written off in the company accounts in 1991, but it is still has A$100m invested in Australian shares and cash.

It is also still sitting on reserves estimated at around 5.3m tonnes of copper and 19m ounces of gold. At current prices of copper and gold, this would amount to around US$40b worth of gold and around US$50b worth of copper.

In the 35 years since the mine has been closed, slow progress is being made not only on the sharing of the profits and royalties, and also on the political and financial self-determination of the indigenous islanders.

In July 2016, Rio Tinto handed over its 54% per cent shareholding in the company to the Autonomous Bougainville Government, for the benefit of local islanders.

In December 2019, the PNG government also undertook to hand over its shareholding to the people of Bougainville. It has not done so yet, presumably holding out as a bargaining chip.

Share price

Since the mine closure in 1989, the share price has been a reflection of speculation not only on the prices of gold and copper, but also on the prospects of a political settlement that might allow the mine to re-open some day in the future.

The share price sank to below 20 cents in the 1990s, spiked up in the 2003-8 China/mining boom, then again in the 2011 China GFC stimulus boom, but sank back below 10 cents in the China slowdown slump in the mid-2010s.

Speculators started to buy shares from 2020 as the prices of copper and gold rose after the Covid scare - gold as a hedge against inflation caused by central bank money-printing and government deficit spending sprees, and copper due to surging demand from EVs and renewables like wind and hydro.

There were also some signs of promising progress toward re-opening the mine.

To the far right of the chart, we can see the share price spiked up at the start of February 2024 when the Autonomous Bougainville Government renewed the company’s exploration lease for another five years.

However, political conditions on the island are far from settled, and plans to re-start the mine are being resisted by the factions within the Autonomous Bougainville Government, and by other local groups on the ground.

You decide!

Investing in mining companies is a gamble at the best of times, but this one has more than the usual array of risks. This one is a pure punt from here. You are literally sitting on a huge gold mine, but you can’t touch it!

It is a reminder of the wealth-destroying power of political risk, and is also yet another reminder that there is no such thing as ‘blue chip’ stock.

This quick, initial snapshot is no substitute for more detailed research required to make investment decisions. Investors, advisers, and portfolio managers should do their own research to arrive at your own conclusions.

You decide!

See also:

Disclosure: I have never owned shares or any other interest in this company. This article is intended for education and information purposes only. It is not intended to constitute ‘advice’ or a recommendation to buy, hold, or sell any stock or security or fund. Please read the disclaimers and disclosures below.

As always, my analysis is fact-based and intended to be as dispassionate as possible, regardless of whether or not I may be a buyer, a seller, or holder. This quick, initial snapshot is no substitute for more detailed research.